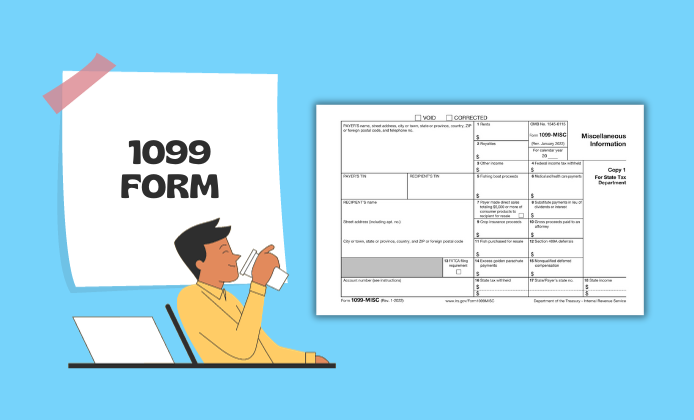

Navigating the labyrinth of tax documents can be daunting, but crucial details stand out when it comes to understanding the IRS 1099 form instructions. The 1099-MISC form is primarily used to report payments made by businesses to individuals who are not employees, such as independent contractors, consultants, and other self-employed professionals.

At first glance, you will notice that the form has several boxes to fill in, each serving a unique purpose. The main fields include:

- Payer's information – here, you outline the details of the business or person making the payment.

- Recipient's information – this is where you insert the name, address, and identification number of the individual or entity receiving the payment.

- Box 1 reports rents, indicating amounts paid for rental property expenses.

- Box 2 is designated for royalties.

- Box 3 generally covers other income, like prizes and awards.

- Box 7 is one of the most frequently used sections, noting nonemployee compensation, the cornerstone for independent contractors' earnings.

The form also includes areas to account for direct sales, crop insurance proceeds, and several other types of payments. Accurate reporting, according to IRS tax form 1099 instructions, hinges on meticulous attention to each box's purpose.

Filling in the 1099-MISC Tax Form

To avoid common pitfalls and potential audits, following these instructions for the 1099-MISC form will assist in preparing your document with precision:

- Verify the accuracy of all taxpayer identification numbers (TINs) and double-check the spelling of names.

- Ensure that the amount paid during the year corresponds correctly to the appropriate box.

- Refrain from entering any non-reportable payments, as stipulated by IRS guidelines.

- Do not include personal payments, as the 1099-MISC is intended for business-related transactions.

- Avoid entering dollar signs or commas in the income boxes, as they are not required and can lead to processing errors.

Following these + 1099-MISC tax form instructions will significantly improve the accuracy of your filings and streamline the review process by the IRS.

The Deadline for 2032 Form 1099

When it comes to filing your taxes, timing is everything. For those needing instructions for Form 1099, particularly regarding the MISC variant, bear in mind that the deadline is usually on or around January 31st for reporting payments made during the previous tax year. This deadline applies to both sending the copy to the IRS and delivering the recipient's copy. However, when the due date falls on a weekend or public holiday, the deadline shifts to the next business day.

Adhering to this due date is critical to avoid potential penalties, so be sure to mark your calendar accordingly. With the right preparation, filling out and submitting the 1099-MISC can be a smooth and stress-free process.

IRS 1099 Form Instructions

IRS 1099 Form Instructions

1099 Miscellaneous Form

1099 Miscellaneous Form