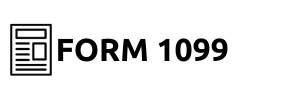

As tax season approaches, it’s crucial for taxpayers who are freelancers, independent contractors or have various forms of non-employment income to understand the significance of the 1099 miscellaneous form. This document, recognized by the federal government, plays a paramount role in ensuring your earnings are reported accurately to the Internal Revenue Service (IRS). Every taxpayer should be familiar with the requirements and process of completing this crucial form.

The Essentials of the 1099-MISC

Simply put, the federal form 1099-MISC is designed for individuals to report payments made to them for services, rent, or other income that doesn’t come from a traditional employer. If you’ve received payment of at least $600 during the year from a client or a company for whom you’ve provided a service, you can expect to receive a 1099-MISC. The form captures a range of information, from rents and royalties to prizes and awards, that doesn’t fall under regular employment. This information will be the foundation for calculating any taxes owed to the IRS.

Where to Secure a Blank 1099-MISC Form in PDF

The process of obtaining a 1099-MISC is fairly straightforward. To ensure tax compliance, it's pertinent to acquire an official version of the blank 1099-MISC form in PDF format. This can be downloaded from our website, or it can be picked up at the local IRS office for those who prefer a physical copy. It is important to use the latest version that corresponds with the tax year you are reporting.

Advantages of an Online 1099-MISC Form

Filling out your tax forms online is typically a more efficient and accurate way to handle tax preparation. An online 1099-MISC form can preempt errors by providing fields that respond to the information you input and by performing automated calculations. Software platforms offer these electronic forms, and you can access it from our website. These options also come with guides and instructions to assist you in filling out your form correctly.

Common Pitfalls in 1099-MISC Preparation

When preparing your 1099-MISC, be wary of common mistakes that can easily derail your tax reporting process. Here are some pitfalls to avoid:

- Misclassifying Workers

Ensure that the individuals you are providing forms for are indeed eligible for a 1099. Misclassifying employees as contractors can lead to hefty fines. - Inaccurate Information

Simple typos in Taxpayer Identification Numbers or addresses can lead to rejected forms. Take time to review all the details. - Omitting Amounts

Failing to report a portion of your income could result in underpayment penalties. Make sure all income figures are reported in full. - Missing Deadlines

Mark your calendar for the IRS deadline. Even being one day late can result in penalties.

Understanding these aspects of the IRS 1099-MISC fillable form can save you considerable time and stress. By taking advantage of online resources and staying meticulous in your reporting, you'll maintain compliance and have a smoother tax filing experience.

IRS 1099 Form Instructions

IRS 1099 Form Instructions

1099 Miscellaneous Form

1099 Miscellaneous Form