In the financial landscape of the United States, IRS Form 1099-MISC for 2023 stands as a critical document utilized by freelancers, independent contractors, and other non-employee individuals to report income received outside of typical employment. This form captures a range of payments, from rents and royalties to various documents of freelance earnings, ensuring the IRS can accurately assess individuals' tax liabilities. Given its significance in the tax filing process, understanding and accurately completing this form is paramount for those navigating the complexities of self-employment or supplemental income streams.

Navigating fiscal responsibilities can be daunting, but resources like our website, 1099form2023.net, prove invaluable for those seeking guidance. With detailed instructions and illustrative examples, the site aids users in grasping the intricacies of the 1099-MISC income tax form. Furthermore, it offers a printable 1099 form for 2023 in PDF format, streamlining the process of fulfilling one's tax obligations by ensuring all necessary information is accurately captured and reported to the IRS. This clear, user-friendly approach can substantially minimize the likelihood of errors, bringing peace of mind to the often stressful tax season.

Tax Form 1099 Meaning for Businesses & Self-Employed Individuals

Navigating the world of taxes can be challenging, but understanding the IRS 1099 form for 2023 printable is crucial for many individuals and businesses. Generally, this form is necessary for those who have received income from sources other than a salary or wage job over the past year. It's a way for the Internal Revenue Service (IRS) to keep track of income you've earned from various other means, such as freelancing, rent, or investments.

When it comes to exemptions, not everyone who earns extra income will need to fill out the 1099-MISC for 2023. The following bullet points outline some key exceptions:

- If your total payments from a single entity do not exceed $600 within the year, you are not required to file the form.

- Personal payments are not reportable; only payments made during your trade or business must be documented.

- Employees receiving a W-2 form should not use a 1099 to report their income.

To maintain compliance with tax regulations, file the 1099 to the IRS within the criteria outlined above. For those who meet the requirements, our website offers the convenience of downloading a blank template or opting to fill out the form online, simplifying the process and ensuring accuracy in submission.

Instructions to Complete the 1099 Blank Form for 2023 Error-Free

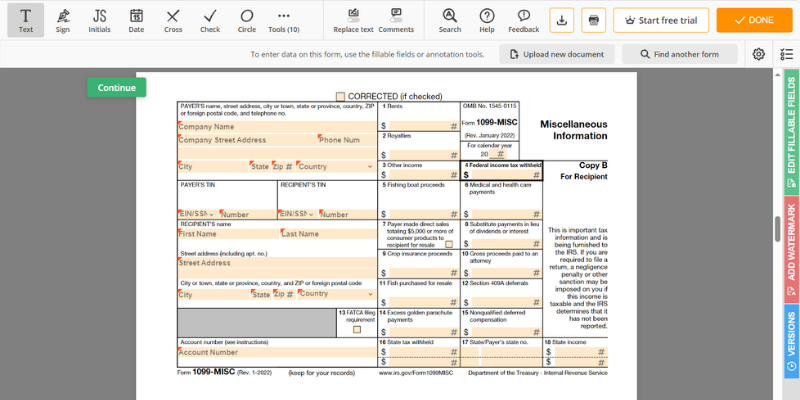

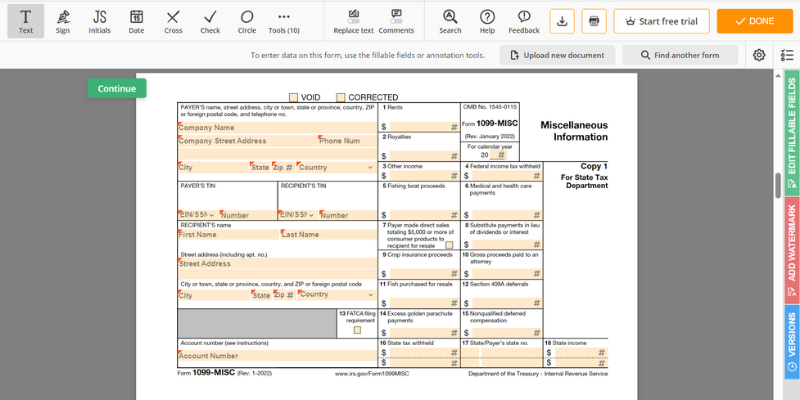

Filing your taxes can be a seamless process with the right resources at hand. For those needing to report miscellaneous income, the 1099-MISC form is essential. Here is a step-by-step guide to help you fill out the 2023 1099 form in PDF accurately:

- Begin by accessing the free fillable 1099-MISC form for 2023 on our website. This template is designed to guide you through the completion process smoothly.

- Ensure you have all necessary information, including your tax identification number and the taxpayer ID of the recipient.

- Within the blank Form 1099 for 2023, enter the total amount of miscellaneous income paid to the individual.

- Carefully fill out the contact information section for both the payer and the recipient, ensuring all details are correct and legible.

- Double-check the document for any potential errors. Accuracy is crucial as mistakes can cause delays in processing or even fines.

- Once you've reviewed your entries, use the website's online filing feature or download and print the PDF to mail your completed copy to the IRS.

Deadline to File Form 1099-MISC to the IRS

When navigating the complexities of U.S. taxation, an important document to remember is the 1099-MISC tax form, often used for reporting payments made during a trade or business to individuals not employed by the payer. The due date to file the 1099 tax form for 2023 printable with the IRS is January 31, 2024. This deadline aligns with the end of the tax year, ensuring that recipients have the necessary information to file their annual returns promptly.

Individuals and businesses filing taxes must ensure they fill the 1099 form accurately and submit it by the due date to avoid penalties. When the deadline cannot be met, it's possible to apply for an extension. The IRS may grant an additional time to file the 1099-MISC, but it's imperative to request this extension before the original filing deadline through the appropriate documents to maintain compliance.

Free Fillable 1099-MISC in PDF - Instructions

Free Fillable 1099-MISC in PDF - Instructions

1099-MISC for Print

1099-MISC for Print

Form 1099 in PDF

Form 1099 in PDF

IRS 1099 Form Instructions

IRS 1099 Form Instructions

1099 Miscellaneous Form

1099 Miscellaneous Form